ri tax rate on unemployment benefits

Unemployment compensation is taxable in South Carolina to the same extent its taxed under federal law. For those employers at the highest tax rate the UI taxable wage base.

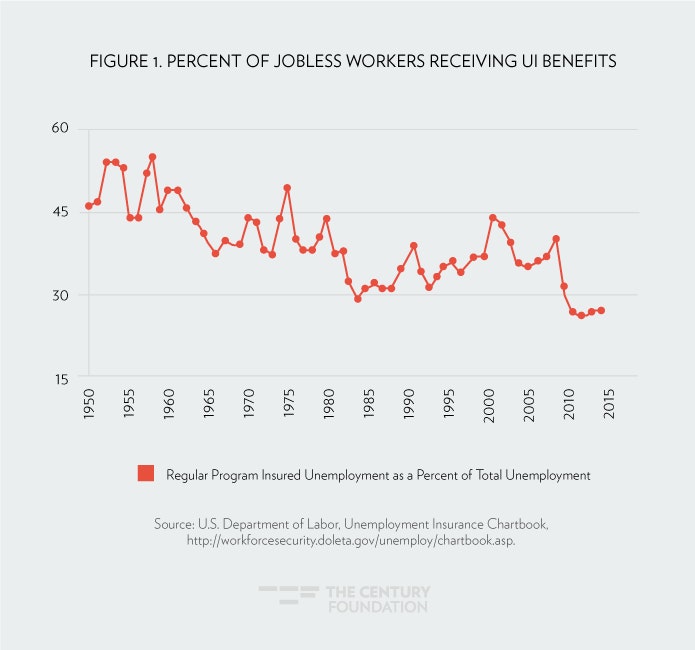

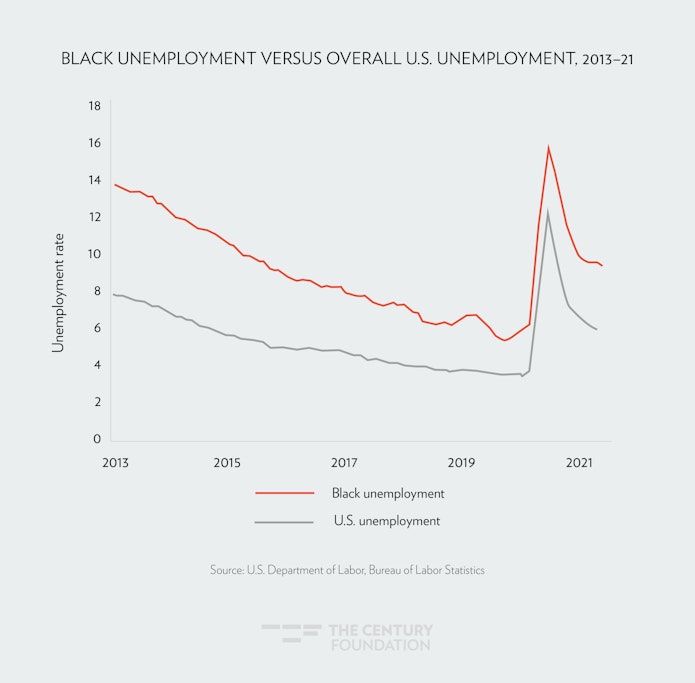

Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

CRANSTON Rhode Island businesses wont see an increase in their unemployment insurance tax rate for 2022 even though the trust fund that keeps benefits.

. Rhode Island is to use a Nov. In your letter please provide your name last four digits of your social security number current address the case number you are appealing and the reason for appealing the decision. Unemployment tax rates are to be determined with Schedule H for 2022 as in 2021 the department said in a news release.

Unemployment insurance payments are taxable income. UI provides temporary income support to workers who have lost their. As a result of this action Schedule H with rates ranging from 12 percent to 98 percent will remain in effect throughout calendar year 2022.

The rate for new employers will be 116. Up to 25 cash back The state UI tax rate for new employers also known as the standard beginning tax rate also can change from one year to the next. This will also be mailed to claimants.

For example that means if your weekly benefit amount is 100 you can earn up to 149 working. Under federal legislation enacted on March 11 2021 if a taxpayer received unemployment benefits in 2020 and the taxpayers federal adjusted gross income AGI was less than. Unemployment benefits received in 2021 are taxed as ordinary income like wages but are not subject to Social Security and Medicare.

Most states send employers a new SUTA tax rate each year. You can now earn up to 150 of your weekly benefit rate and still receive a partial benefit. For all unemployment claimants that received benefits in 2021 the 1099-G form is now available to download on the DLT website.

30 computation date Moving the computation date is to avoid assessing higher unemployment tax rates for 2022 Under the order 21-102 the. UNEMPLOYMENT TDI TCI INSURANCE INSURANCE TAXABLE WAGE BASE 24600 74000 For Employers at the highest tax rate26100 TAX SCHEDULESSchedule H. For those employers at the highest tax rate the UI taxable wage base.

Unemployment Insurance UI is a federalstate insurance program financed by employers through payroll taxes. Rhode Island unemployment insurance UI tax at a glance 2020 2021 Taxable wage base 24000 24600 Tax rate schedule F H Tax rate range 069 to 919 099 to 959 Tax rate. Generally states have a range of unemployment tax rates for established employers.

This is an increase of 7500 101 from the 2021 taxable wage. Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600. However the State of Rhode Island will use the same tax rate schedule for 2019 that it used for 2018 -- Schedule G.

In recent years the employment security tax component generally has been around 275 and the job development tax. Unemployment benefits are normally. 26100 for those employers that have an experience rate of 959 or higher Employers will be notified in late December of.

The 2021 SUI tax rates were assigned based on Rate Schedule H with rates from ranging from 099 to 959 up from 069 to 919 for 2020 on Rate Schedule F. Tax rates are to range from 12 to 45 for. State Taxes on Unemployment Benefits.

You will need to pay 6 of the first 7000 of taxable income for each employee per year which makes your maximum FUTA tax per employee per year 420Note that if you. WPRI Any Rhode Islanders who received unemployment benefits during 2020 will have to pay state taxes on them. The rate for new.

Your state will assign you a rate. State Income Tax Range. The regular rules returned for 2021.

The form will show the amount of unemployment. Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600. Effective January 1 2021 the Unemployment Insurance Tax Schedule will go to Schedule H with tax rates ranging from 12 percent to 98 percent.

The SUI taxable wage.

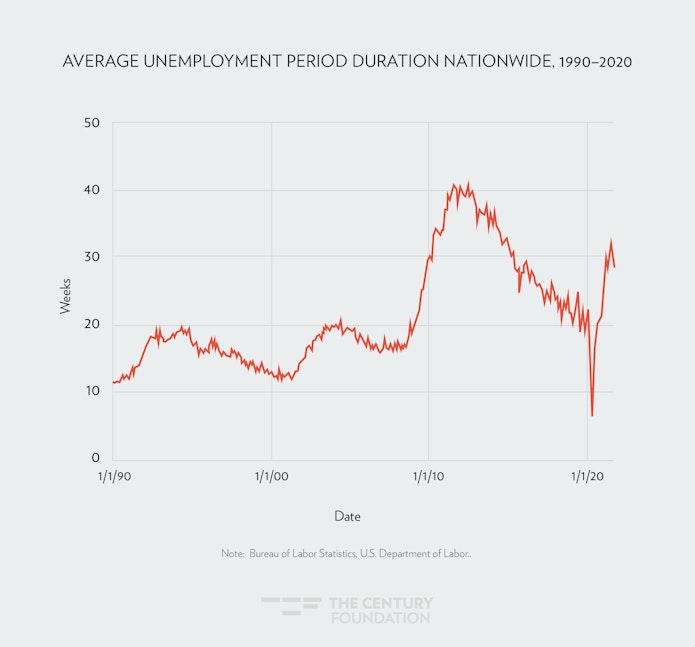

The Unemployment Impacts Of Covid 19 Lessons From The Great Recession

Unemployment Insurance Improvement Act Nails Key Floorboard Under State Programs

Andy Boardman Here S How A Rhode Island Employment Bonus Proposal Would Work And How It Can Be Improved

Unemployment Benefits New York And 10 Other States Are Still Taxing Unemployment Benefits Here S What That Means For You Cnn Politics

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

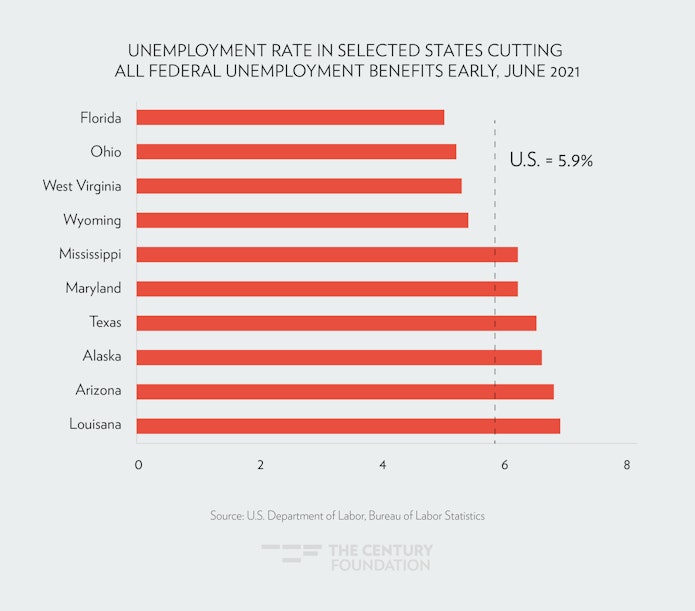

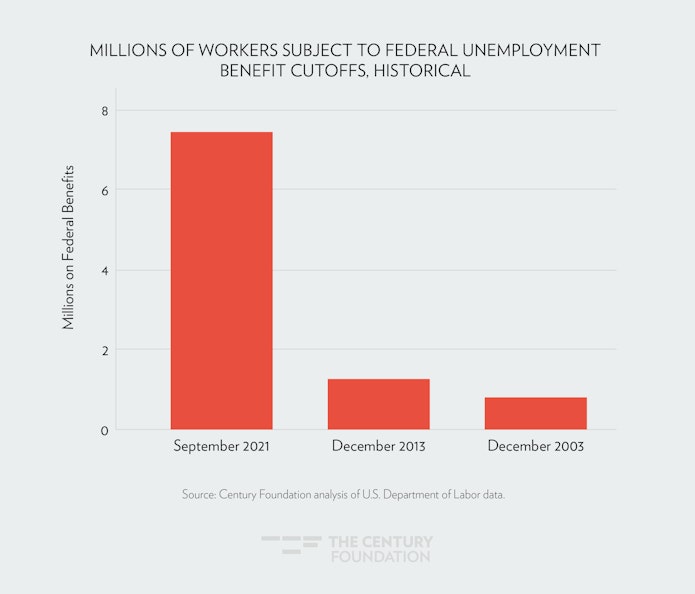

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

Andy Boardman Here S How A Rhode Island Employment Bonus Proposal Would Work And How It Can Be Improved

600 Unemployment What Happens When A Stimulus Lifeline Ends The New York Times

/dotdash_Final_Okuns_Law_Economic_Growth_and_Unemployment_Oct_2020-01-2e5dd7aa7c194e14a82707b84b00d1a3.jpg)

Okun S Law Economic Growth And Unemployment

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

Is Unemployment Taxable State By State Guide To Unemployment Benefits

600 Unemployment What Happens When A Stimulus Lifeline Ends The New York Times

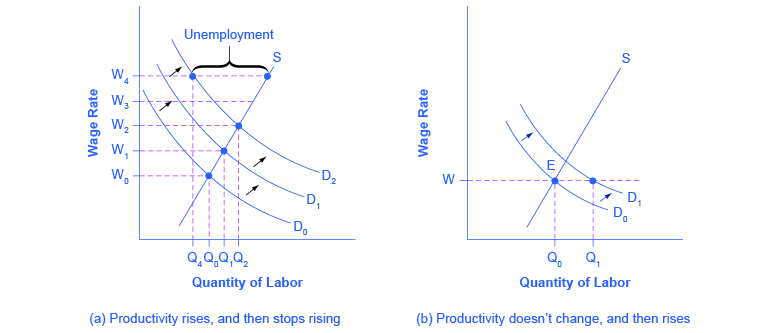

21 4 What Causes Changes In Unemployment Over The Long Run Principles Of Economics